✨ In most cases, you don’t need to create reconciliations manually — Digits starts them automatically whenever a statement is uploaded.

Manual reconciliations are an additional option for situations where:

An account isn’t automatically matched to a statement, or

You’re setting up historical periods for the first time.

Note on Auto-Reconciled Transactions

All automated transactions — including those from your connected banks — are automatically marked as settled by default.

Manually created or CSV-uploaded transactions must be manually marked as reconciled within the reconciliation view.

Starting a Manual Reconciliation

You can start a reconciliation directly from the Reconciliations Dashboard in two ways:

Click “+ New Reconciliation” at the top of the screen.

(Use this if you don’t see the bank or credit card listed below.)Click on a month in the timeline, then choose Start Manually from the dropdown.

Already have a statement? Just upload it — Digits will automatically start reconciling for you.

See Using AI Bank Reconciliations in Digits to learn how it works.

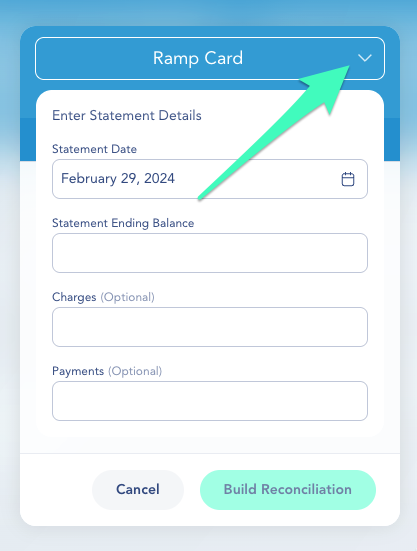

Then enter your reconciliation details:

Statement Date

Ending Balance

(Optional) Deposits/Withdrawals or Charges/Payments (for liability accounts)

Use the Category dropdown at the top of the setup screen to change the account.

When ready, click Build Reconciliation → Digits will generate your reconciliation view.

First-Time Setup: Digits doesn’t import reconciliations from QBO. To get started, create reconciliations for prior periods. You can reconcile by month or in one bulk action. All pre-cutover QBO transactions are marked as reconciled by default.

Reconciling a Category

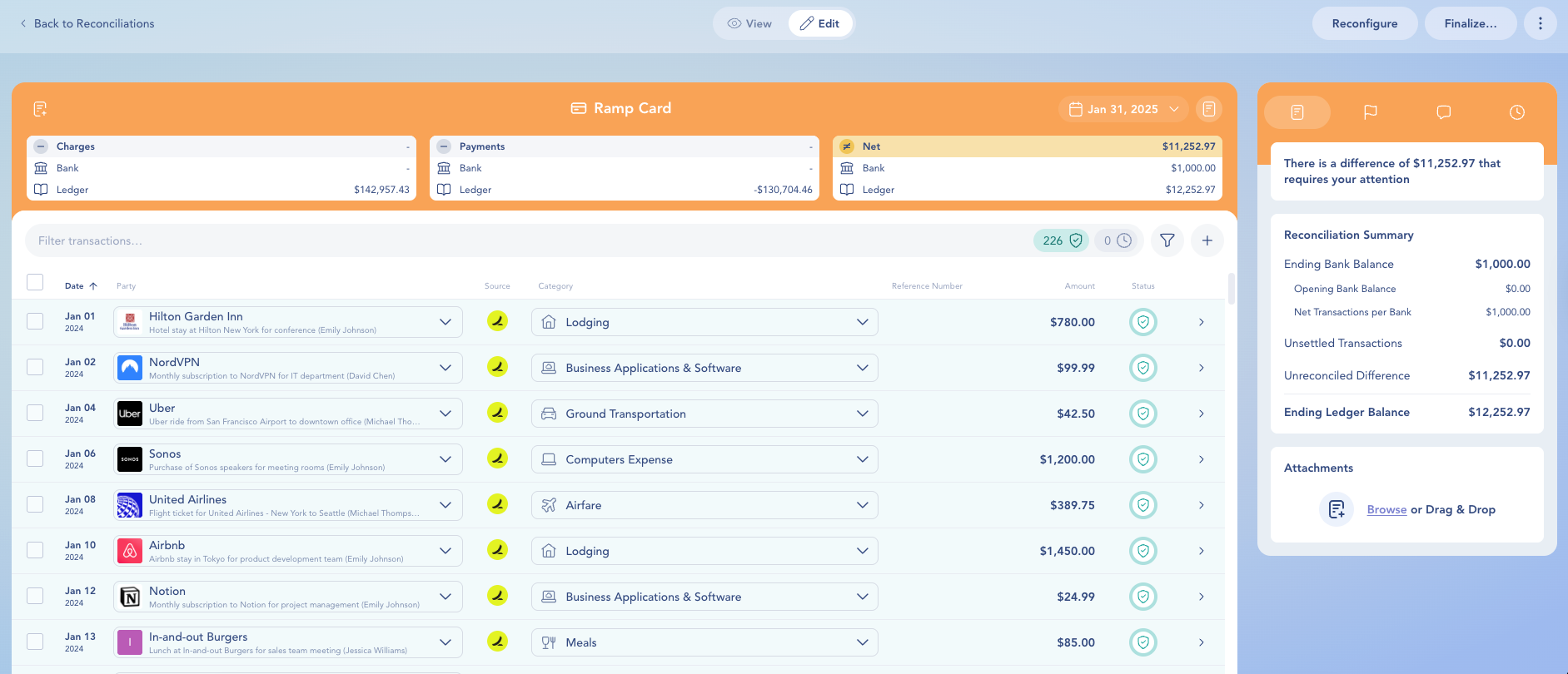

Once you’ve started a reconciliation, you’ll land on a detailed view like the one below:

What You’ll See

- All transactions from the last finalized reconciliation up to your selected end date.

- Unsettled transactions carried forward from earlier periods.

Available Features

- Filters for narrowing results by amount, date, or status.

- Checkboxes for bulk or individual reconciliation.

- Counts for reconciled and unsettled transactions.

- Manual Transaction button to add missing entries.

- Status icons showing which transactions are complete and which need review.

Bulk Editing Transactions

You can adjust multiple transactions at once to save time and ensure accuracy.

Select the checkboxes next to the entries you want to update.

Then choose one of the following actions:Update the party name or related category

Edit departments (

Match or unmatch transactions

Mark as Reconciled or Unsettled

View the total sum of selected items to confirm your reconciliation balances correctly

Finalize, Reconfigure, or Delete

In the top right corner, you have the following options:

FAQs

Why don’t I see a category listed?

If a bank or credit card isn’t showing, it usually means the account has no activity for the selected period.

Accounts with no transactions and a zero balance appear under No Activity by default.

If you drag and drop a statement onto the Reconciliations screen (not onto a specific account), Digits may not be able to match it to a category, since there’s no existing activity to compare against.

In that case, you can start the reconciliation manually by clicking Start Reconciliation and selecting the correct category.

Why can’t I finalize my reconciliation?

Digits only allows finalization when everything balances to $0.00.

If the Finalize button is still greyed out, check for:

- A remaining net difference in the reconciliation amount

- A prior period that hasn’t been finalized yet

- Or any unresolved flags from a statement you uploaded

Flags may appear if transactions need review or correction before Digits can finalize.

See Using AI Bank Reconciliations in Digits to learn how Digits automatically detects and helps you clear these flags.

Why are some transactions missing?

Make sure the transactions exist in your Ledger and fall within the reconciliation’s date range.

If they were uploaded separately or imported via CSV, confirm they include valid transaction dates.

Why am I seeing too many transactions?

Check your ending date — you may have included transactions from future periods.

Also note that unsettled transactions from earlier reconciliations automatically carry forward into the current one until they’re matched or finalized.

Have questions? Our support team is here to help keep your reconciliations on track.